The Average Directional Index technical indicator was created by J. Welles Wilder with the intention of having an objective measurement of the strength of a trend. This is an important feature as we often trade trending markets different from sideways market. For example, overbought RSI in an up trending market is not a signal to go short whereas overbought relative strength index-RSI in a trading range is much closer to being a signal. The ADX is far from perfect. It has the same issue like other technical indicators of lagging the price action and it doesn’t tell you what the direction of the trend is.

Learn to Identify Strength of a Trend using This Technical Indicator

ADX is calculated by using a moving average of price expansion over a specific period. The default settings are 14 but this can of course be changed to suit your style and timeframe. The ADX is derived from two directional movement indicators (DMI).

ADX oscillates between 0 and 100 where readings above 60 are rare. It is therefore important to split the values up into categories.

- 0-25 Sideways market

- 25-50 Trending market

- 50-75 Strong trending market

- 75-100 Very strong trending market

So, how can we trade using the average directional index technical indicator? The ADX is a great tool to help you pick the best trending instruments before looking for specific entry signals. It is also a great tool for traders who trade the fade.

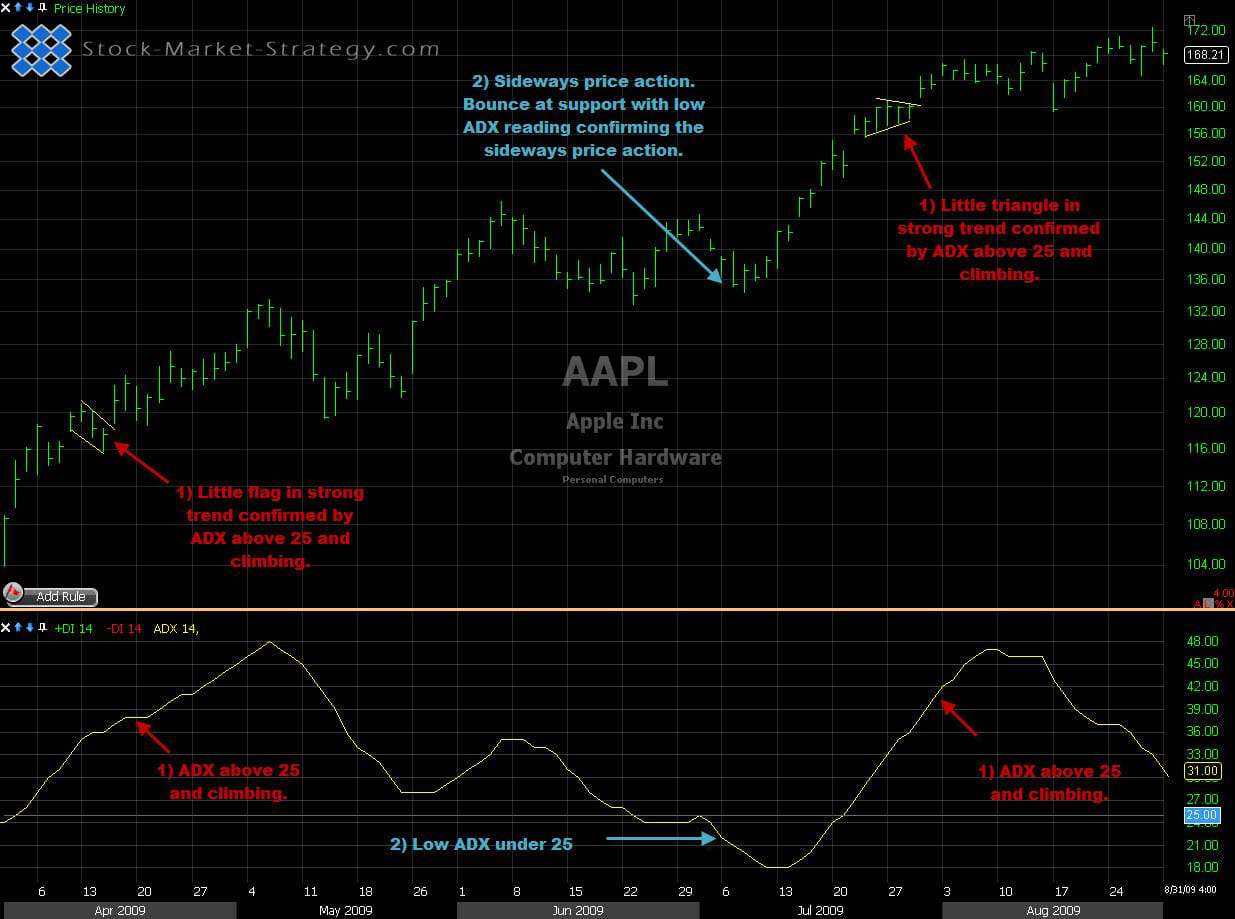

1. Using ADX as a filter when looking for continuation patterns is a great idea. Small continuation patterns such as flags work best when the preceding trend has been strong. By only taking the entry when ADX shows a reading of min 25 you will increase your odds tremendously.

2. If you are a trader who likes to picks tops and bottoms then it is better to do so in sideways market. Here you can simply say that if the ADX is under 25 then your filter gives you the signal to look for entries.

Trend Trading With Average Directional Index - ADX

Our Implementation of Technical Analysis Using ADX

I personally like being a bit picky about my trades so I add a little rule to my ADX filter saying that ADX needs to be above 25 for 3 bars before I considering it to be trending. The opposite can be said for a ranging market of 3 bars under 25. Look back on some charts to see what length works best for you.