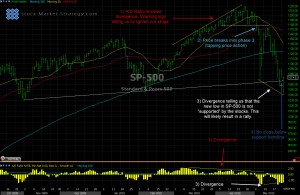

Timing Your Entry Chart 1[/caption]

If you have been following our updates you will be fully aware that we called the top in April and have been stating our position in the market which is cash is king and be ready on the sidelines.

We now believe from our analysis that the time has come to open your wallet and start thinking about where you are going to place some trades. We believe this because of our technical analysis and diligent money management profiling which allows us to seek the highest opportunity stocks with the greatest risk to reward. Our analysis also tells us that the balance is moving in the favourable direction of the patient trader.

Stock Market Strategy is a paid member's service and the official launch is around the corner. However we believe that as you have taken the time to register for our free Market Analysis Newsletter it's only fair that we give something back by showing you a glimpse of how we profit from the market.

As mentioned above, the selloff that the market has experienced in the last 3 weeks has been quite volatile with plenty of high range bars. We have talked about, in the past, the level of support in the trend line support area which has held up on a closed basis and showed some impressive rejection. From the previous updates we can now prove that we called the top, the cash is king stage and at this moment in time we have called the rejection at the support area.

We dipped our toe in the water two days ago on three stocks we think have a great risk to reward and some nice upside potential. This was prior to the volume flush out that we saw yesterday but the stocks still held up due to their Relative Strength which meant they did not move a great deal when the market fell. These are not trades that we would necessarily recommend to our lower risk members but this will be a service that we offer in the future to members that like to speculate at points in the market where it shows strength giving greater risk to reward.

We have traded today which is prior to our full signal but it also shows great risk to reward and plenty of upside potential. We are only in the stock with half our full market position until we get 100% confirmation from the market and the stock itself, both which should come together.

Timing Your Entry Chart 1[/caption]

If you have been following our updates you will be fully aware that we called the top in April and have been stating our position in the market which is cash is king and be ready on the sidelines.

We now believe from our analysis that the time has come to open your wallet and start thinking about where you are going to place some trades. We believe this because of our technical analysis and diligent money management profiling which allows us to seek the highest opportunity stocks with the greatest risk to reward. Our analysis also tells us that the balance is moving in the favourable direction of the patient trader.

Stock Market Strategy is a paid member's service and the official launch is around the corner. However we believe that as you have taken the time to register for our free Market Analysis Newsletter it's only fair that we give something back by showing you a glimpse of how we profit from the market.

As mentioned above, the selloff that the market has experienced in the last 3 weeks has been quite volatile with plenty of high range bars. We have talked about, in the past, the level of support in the trend line support area which has held up on a closed basis and showed some impressive rejection. From the previous updates we can now prove that we called the top, the cash is king stage and at this moment in time we have called the rejection at the support area.

We dipped our toe in the water two days ago on three stocks we think have a great risk to reward and some nice upside potential. This was prior to the volume flush out that we saw yesterday but the stocks still held up due to their Relative Strength which meant they did not move a great deal when the market fell. These are not trades that we would necessarily recommend to our lower risk members but this will be a service that we offer in the future to members that like to speculate at points in the market where it shows strength giving greater risk to reward.

We have traded today which is prior to our full signal but it also shows great risk to reward and plenty of upside potential. We are only in the stock with half our full market position until we get 100% confirmation from the market and the stock itself, both which should come together.

Stock Market Strategy Watchlist

Here is our watch list of stocks that have the potential to give good risk to reward. Remember we are still waiting for confirmation to enter.

Disclaimer: stock-market-strategy.com are not financial advisors, and does not recommend the purchase of any stock or advice on the suitability of any trade or investment. Stock trading and investing can cause loss of capital, and you should always consult with a professional financial advisor before trading or investing.